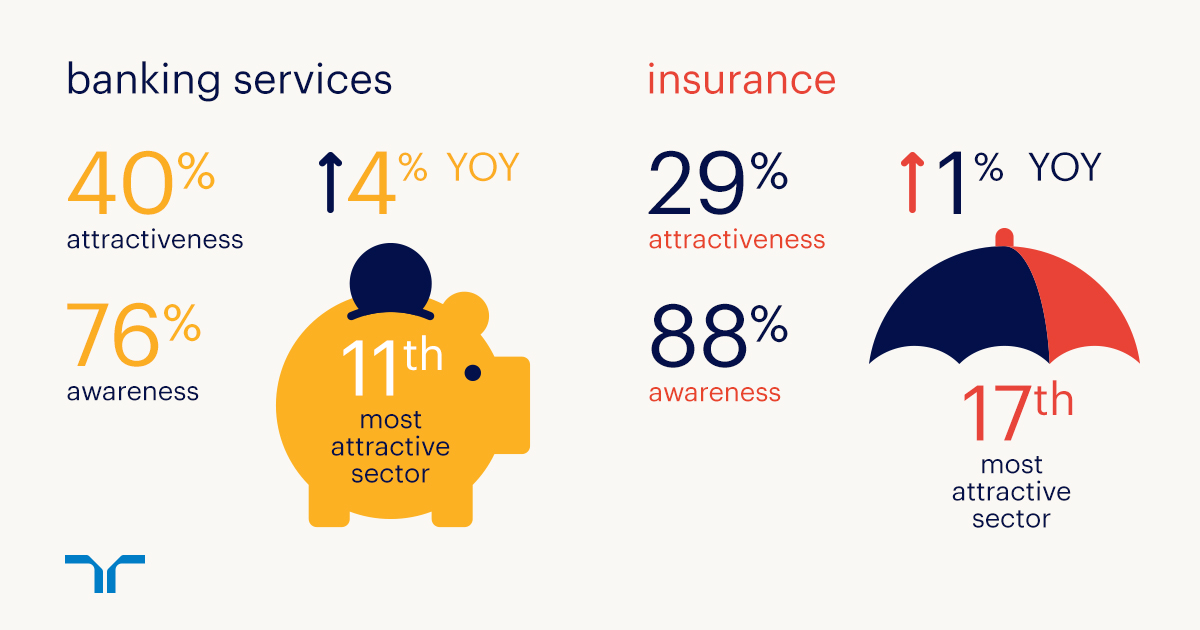

This year’s Employer Brand Research revealed that the attractiveness scores for the largest commercial employers in Singapore within the banking and insurance sectors increased from 2017. This indicates that companies have been doing more to strengthen their employer brand through effective attraction and retention strategies.

most attractive banking and insurance employers in singapore

When asked to profile the attractiveness of banks and financial institutions, people around the world were more likely to rank companies higher on financial-related employee value proposition factors. Banks and insurance companies that were rated the most attractive to the local workforce demonstrated strong financial health, good corporate reputation and an ability to provide job security.

These are the cues that employees and job seekers look for in an employer as they hint toward growth opportunities. When a company is doing well financially, people tend to expect a faster and more robust career development roadmap. This means they want the opportunity to deepen their capabilities and learn new knowledge from experts, as well as to know of their promotion potential. As they get to learn new skills and gain new experiences, employees are more likely to stay with the company.

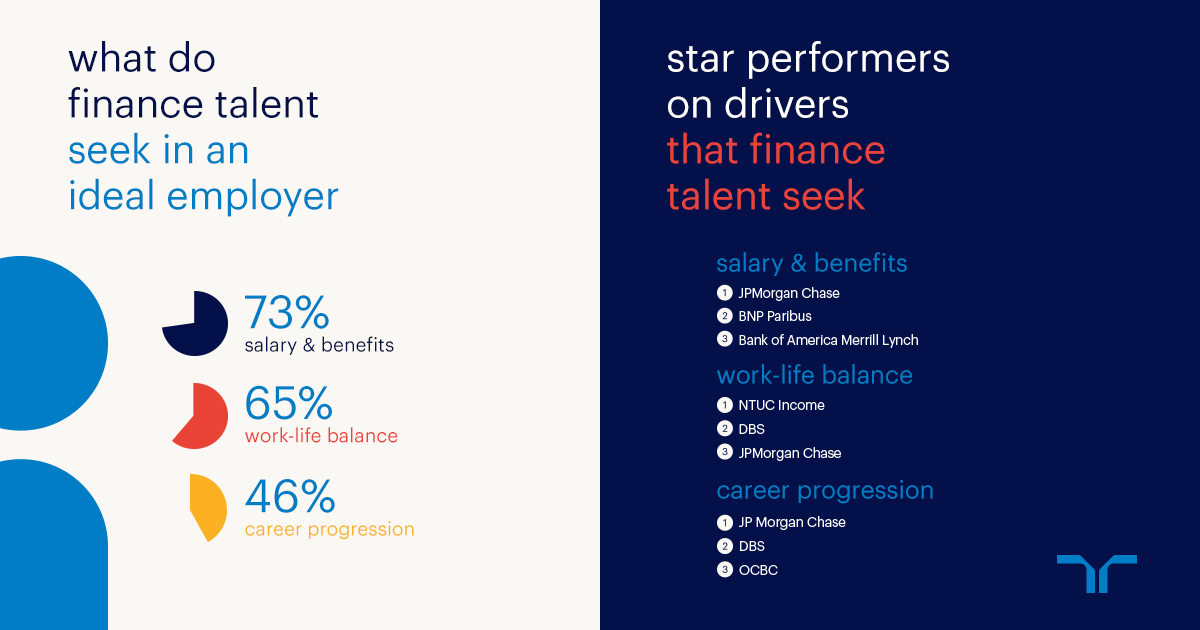

‘salary and benefits’ most important to finance talent

‘Salary and benefits’ continues to be the most important motivator for employees and job seekers when looking for an ideal employer in the banking and financial services sectors. This is a consistent trend in the last six years that we’ve conducted the Employer Brand Research in Singapore.

The financial sector has taken great leaps in digital innovation this year and many had even communicated their vision to go ‘full-digital’. This change means that there will be new job titles and refreshed scopes and responsibilities, which will require the workforce to constantly upskill themselves and be open to digital integration. As a result, candidates with desired soft skills and a hunger for knowledge would expect a higher salary and better benefits from their ideal employers as they will be able to deliver added value to companies.

Second to monetary compensation, finance professionals are also attracted to companies that can provide a healthier work-life balance. We are beginning to see more companies take up a family-first approach when developing work-life balance policies. This means taking care of their employees’ partners, children and parents by providing adequate medical coverage for the family, paternity leave as well as paid time-off so that they can spend more time with their family and more.

need better clarity on job progression opportunities

As more companies focus on improving customer experience through a digital approach, it is clear that employees need to be more productive and open to working with new technology such as artificial intelligence. Existing employees who are still using the traditional systems will not know what type of new skills they need to acquire to transit and might not feel confident about their future within the company.

Companies need to ensure that the workforce is prepared for the digital transformation by providing training programmes to equip them with new skills and knowledge and also communicate how the changes will affect the existing employees.

what’s next for banks and financial institutions

We are seeing an increasingly strong focus on customer experience, and companies are hiring finance and tech experts to ensure a seamless service delivery to compete for a larger market share.

Finance talent is expected to collaborate and work across different functions within the organisation. For example, a relationship manager is now expected to use data to analyse customers’ risk profiles and deliver a more targeted portfolio to each of them; and data scientists need to have an exceptional commercial acumen to make financial sense of the large volume of data to improve customer experience.

In order to build a workforce that has the capabilities to drive and accelerate business growth, companies need to start building a compelling employer brand that appeals to the people they want to hire. Those with the desire to stand out would need to offer more than just an attractive compensation package. Candidates are looking for more support from their employers to help them strike a healthy balance between work and life, as well as achieve their career aspirations. With opportunities to deepen their capabilities and expand their knowledge, employees can also have a clearer idea of how their career path will look like.

This means that in order to become the company that people want to work for, employers need to start meeting or even exceeding, their employees’ expectations.

employer brand research: banking and financial services

The banks and financial services companies included in the Randstad Singapore’s Employer Brand Research 2018 are - AXA, BNP Paribas, Bank of America Merrill Lynch, Citibank, DBS (Development Bank of Singapore), Deutsche Bank, Great Eastern, HSBC (The Hongkong and Shanghai Banking Corporation), JPMorgan Chase & Co, Maybank, NTUC Income, OCBC (Oversea-Chinese Banking Corporation), Standard Chartered Bank, SMBC (Sumitomo Mitsui Banking Corporation), UBS AG and UOB (United Overseas Bank).

Do you have what it takes to attract talent and build a healthy pipeline of experts in your company? Connect with us to find out how you can get high-performing specialists to work with you.